-

×

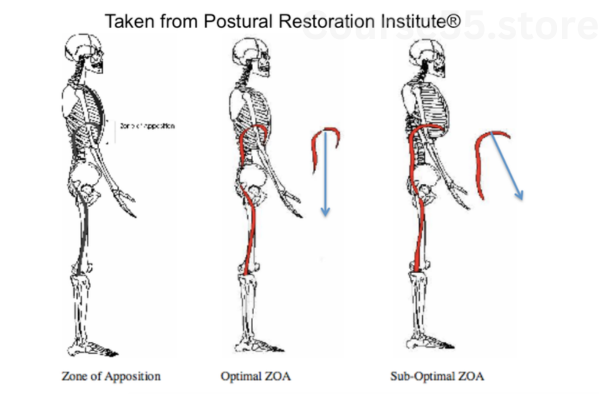

Postural Respiration 2017 by Postural Restoration Institute

1 × $23.10

Postural Respiration 2017 by Postural Restoration Institute

1 × $23.10 -

×

Pay Per Call Exposed By Raj

1 × $23.10

Pay Per Call Exposed By Raj

1 × $23.10 -

×

Options Foundations Class by Dan Sheridan

1 × $23.10

Options Foundations Class by Dan Sheridan

1 × $23.10

Learn To Trade Earnings By Dan Sheridan

$297.00 Original price was: $297.00.$23.10Current price is: $23.10.

Learn To Trade Earnings By Dan Sheridan – Digital Download!

Content Proof:

Learn To Trade Earnings By Dan Sheridan

Overview:

A Thorough Analysis of Dan Sheridan’s Learn to Trade Earnings

Few people in the trade and financial industries are as well-known as Dan Sheridan, especially in the context of options trading. His “Learn to Trade” course has drawn notice for its successful strategy for negotiating the choppy waters of earnings releases. Since these crucial events have the potential to greatly affect stock prices and market dynamics, it is crucial for traders to learn how to handle them. We will examine the finer points of Sheridan’s teaching approach, the tactics he stresses, and how these might help novice and experienced traders in this study.

Earnings Announcements’ Significance in Trading

A company’s success and the state of the market are both significantly influenced by its earnings statements. Stock prices frequently fluctuate significantly after these statements, which can present profitable trading opportunities. By informing traders about the financial ramifications of these statements, Dan Sheridan takes advantage of this phenomena.

The idea of implied volatility, which usually rises prior to earnings reports and then tends to fall precipitously after the announcement of financial results, is highlighted in Sheridan’s instruction. This volatility is important because it fosters an atmosphere that is favorable for trading, particularly for those who use options strategies. Traders can improve their capacity to predict market moves and modify their strategies appropriately by becoming proficient in these dynamics.

For instance, knowing implied volatility enables traders to decide, based on their risk tolerance and market opinions, whether to start a position prior to an earnings release or to wait until after the announcement. Successfully understanding these ideas improves a trader’s odds of making money while lowering their risk of losing money.

Options Strategies for Earnings Trading

Among the various strategies Dan Sheridan advocates, straddles and strangles are particularly noteworthy. These approaches allow traders to engage in the market effectively while regulating their risk exposure.

- Straddle: A strategy that involves purchasing both a call and a put option at the same strike price with the same expiration date. This approach benefits traders who anticipate significant price movements in either direction.

- Strangle: Similar to the straddle, a strangle involves buying a call and a put option but at different strike prices. This can be a more cost-effective strategy when traders expect volatility but are uncertain of the price direction.

Using these strategies, traders can position themselves favorably around earnings announcements. By understanding the mechanics of how these plans work, traders can not only protect their portfolios but also seize potential market opportunities. Sheridan’s teachings provide the framework necessary for implementing these strategies effectively, ensuring participants are well-prepared for the fluctuations that often accompany earnings announcements.

Combining Practice and Theory

Dan Sheridan’s distinctive fusion of theoretical understanding and real-world application is what distinguishes his instruction. His classes are designed to accommodate traders of all skill levels, guaranteeing that even individuals who are unfamiliar with profits trading may successfully understand difficult ideas.

Sheridan frequently simplifies complex concepts into easily understood chunks during his sessions, which makes learning not just simple but also interesting. For example, he uses real-world examples that show the tactics in action rather than just dry theoretical explanations. This method not only promotes comprehension of complex ideas but also increases traders’ self-assurance in using what they’ve learnt.

Furthermore, Sheridan’s resources—such as webinars and podcasts—offer continuing education possibilities outside of the classroom. These resources are frequently enhanced with new information and revised tactics according to the state of the market, enabling traders to stay knowledgeable and flexible.

Mentoring and Community Engagement

While the frequency of Dan Sheridan’s mentoring sessions may have declined recently, traders still have access to a wealth of material offered through diverse platforms. This accessibility has led to the formation of a community of traders who actively engage with one another. Such an environment fosters collaboration, wherein traders share their experiences, strategies, and insights, further enhancing the learning experience.

Participating in a community centered around learn to trade not only helps reinforce the concepts taught in Sheridan’s courses but also builds a support network for traders. Engaging with peers allows individuals to gain different perspectives on market conditions and trading strategies, which can be invaluable for improving one’s trading skill set. This peer-to-peer interaction can often lead to valuable insights that might not be readily apparent through solitary study.

Feedback from Past Participants

Traders who have engaged with Sheridan’s materials often report notable improvements in their understanding of market dynamics, particularly regarding earnings-related volatility. Many highlight the effectiveness of learning techniques that specifically aim to mitigate risks associated with earnings reports.

Examples of positive feedback include:

- Enhanced ability to interpret market reactions post-announcement

- Increased confidence in trading strategies during earnings seasons

- A deeper comprehension of the relationship between implied volatility and stock price movements

These reviews emphasize that Sheridan’s materials not only focus on executing trades but also prioritize developing a comprehensive understanding of market mechanics. This holistic approach equips traders with the confidence to navigate the complexities associated with earnings announcements.

Key Takeaways

To summarize the essence of Dan Sheridan’s “Learn to Trade” program, several key takeaways stand out:

- Mastering Volatility: Understanding implied volatility and its impact on stock prices is critical for successful earnings trading.

- Strategic Options Utilization: Familiarity with strategies such as straddles and strangles can lead to better risk management and capitalizing on price swings.

- Engaging Learning Methodology: Sheridan’s blend of theory and practical application makes the course accessible and effective for traders at all levels.

- Ongoing Education: Access to a wealth of materials beyond the initial course allows continual growth and adaptation to changing market conditions.

- Community Support: Engaging with a community of traders enhances learning and provides valuable perspectives that can inform trading decisions.

The curriculum offered by Dan Sheridan is a respectable option for anyone wishing to improve their trading abilities, especially in the complex field of earnings releases. By giving traders the essential knowledge of market dynamics in addition to the how-to of trading, participants are better equipped to make wise choices in the frequently volatile trading environment.

To sum up, Dan Sheridan’s “Learn to Trade” is about developing a thorough understanding that empowers traders to prosper in a competitive environment, not just about making trades. His seminars give students the groundwork for successful trading in the ever-changing world of earnings releases by focusing on strategic options trading and good risk management techniques.

Frequently Asked Questions:

Business Model Innovation: We use a group buying approach that enables users to split expenses and get discounted access to well-liked courses.

Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations.

There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content.

This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Assurance: We guarantee that every course resource you buy is exactly the same as what the authors themselves are offering.

It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings:

– Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “Learn To Trade Earnings By Dan Sheridan” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.