-

×

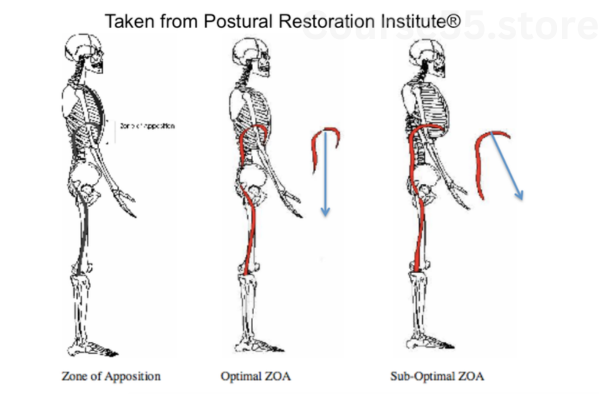

Postural Respiration 2017 by Postural Restoration Institute

1 × $23.10

Postural Respiration 2017 by Postural Restoration Institute

1 × $23.10 -

×

The Power of Pinning by Melanie Duncan

1 × $23.10

The Power of Pinning by Melanie Duncan

1 × $23.10 -

×

Acquisition Goal Attainment System by Kevin Hogan

1 × $23.10

Acquisition Goal Attainment System by Kevin Hogan

1 × $23.10 -

×

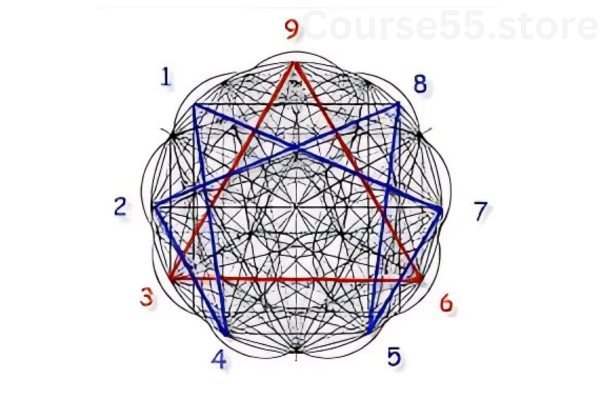

Private Seminars by Earik Beann

1 × $23.10

Private Seminars by Earik Beann

1 × $23.10 -

×

Applied Wing Chun - Lesson 002 - Sil Lum Tao (Part 2) By Larry Saccoia

1 × $8.00

Applied Wing Chun - Lesson 002 - Sil Lum Tao (Part 2) By Larry Saccoia

1 × $8.00

Making Good Deals In Bad Times by John Schaub

$299.00 Original price was: $299.00.$23.10Current price is: $23.10.

Making Good Deals In Bad Times by John Schaub – Digital Download!

Content Proof:

Making Good Deals In Bad Times by John Schaub

Overview:

A Comprehensive Analysis of John Schaub’s Real Estate Investing Course: Getting Good Deals During Hard Times

Opportunities and difficulties frequently coexist in the realm of real estate investing, especially during tumultuous market times. For both new and experienced investors, John Schaub’s course, “Making Good Deals in Bad Times,” provides priceless insights. As more than 250 enthusiastic investors came to hear John Schaub and Jack Miller discuss tactics pertinent to the changing market, this eagerly awaited event acquired substantial popularity in late 2006. Schaub stresses the significance of finding cheap properties, enabling investors to accumulate wealth even in the face of economic difficulties, with an emphasis on practical tactics and real-world applications. In-depth study of how business owners might handle the difficulties of real estate in unpredictable times will be provided by this review, which will examine the main ideas, lessons, and tactics that Schaub offered.

The Background of the Course

“Making Good Deals in Bad Times” is not just a mere collection of theories; it is a comprehensive course drawn from John Schaub’s extensive experience in real estate. With more than 30 years of hands-on investment experience, predominantly in Sarasota, Florida, Schaub brings a wealth of knowledge to the table. His emphasis on practical strategies over paid coaching sets him apart from many others in the industry. Investors regard his teachings highly, knowing that they stem from years of real-world experience rather than mere speculation.

John Schaub and Jack Miller engaged in a stimulating discussion about two opposing investment methods at the event that served as the impetus for the creation of the course. While Schaub promoted ongoing purchases of real estate at discounted rates, especially from distressed sellers facing foreclosures, Miller promoted a more cautious approach to asset sales in order to generate money and take advantage of potential future purchases. The foundation for investors to critically evaluate their strategies in a volatile market was established by this discussion.

Key Concepts of the Course

The core of Schaub’s teachings can be distilled into actionable principles that guide investors through difficult times. Here are some of the essential topics covered in the course:

- Identifying Bargain Properties: One of the primary strategies emphasized by Schaub involves keenly observing the market to find undervalued properties. He encourages investors to look for opportunities from lenders and speculators who may need to sell quickly, allowing savvy investors to acquire assets below market value.

- Market Analysis and Timing: Understanding the market cycle is crucial for any investor. Schaub discusses how to analyze trends and economic indicators that can signal the right moment to buy or sell properties.

- Creative Financing Options: In times of financial difficulty, traditional financing may not always be available. Schaub introduces various creative financing methods, including lease options, owner financing, and partnerships, which can help investors acquire properties without large out-of-pocket expenses.

- Building Wealth and Sustainability: The ultimate goal of any real estate strategy is to build wealth. Schaub provides strategies aimed at maximizing returns and ensuring long-term sustainability in investments, which is particularly valuable during adverse economic conditions.

Various Views on Investing Techniques

The conversation between Schaub and Miller during the 2006 event demonstrated different approaches to investing. In spite of an unfavorable market, Schaub’s strategy focuses on taking advantage of opportunities when real estate prices are low, opening doors for wealth accumulation. Miller’s perspective, on the other hand, highlights the value of liquidity by arguing that occasionally taking a step back can result in bigger gains down the road.

This comparison of viewpoints offers a comprehensive understanding of investing in uncertain times. Both strategies can teach investors important lessons. For example, some people might think it wise to sell off some assets while continuing to look for new opportunities or perhaps putting a hybrid plan into place that combines aspects of Schaub and Miller’s ideas.

Practical Applications for Investors

The actionable strategies discussed in “Making Good Deals in Bad Times” lend themselves to real-world application. Here are some practical steps that investors can implement in line with Schaub’s teachings:

- Conduct Thorough Market Research: Continuously monitor local market conditions, including supply and demand dynamics, property values, and economic indicators. This research will aid in identifying potential investment opportunities.

- Attend Networking Events: Engaging with other investors and industry professionals can provide insights into emerging trends and opportunities that may not be apparent through traditional research channels.

- Invest in Education: As a firm believer in knowledge as an asset, Schaub encourages ongoing learning. Participating in workshops, webinars, and local real estate meetings can help investors stay informed and refine their strategies.

- Utilize Tech Tools: Embracing technology can enhance the way investors analyze properties. There are numerous software programs and mobile apps available for managing listings, comparing prices, and accessing vital demographic data.

Disparities in Engagement and Teaching Style

John Schaub’s dedication to making education affordable is another admirable feature of his strategy. Schaub ensures that a larger audience can benefit from his extensive knowledge by providing instructional sessions at modest charges, in contrast to many professional trainers who charge outrageous fees. In addition to demonstrating his commitment to the industry, this candor creates a cooperative atmosphere where new investors are encouraged and prepared to learn.

By enabling participants to ask questions and share their experiences, the course model promotes engagement and conversation. Because participants frequently learn as much from one another as they do from Schaub himself, this collaborative environment improves the educational experience.

Case Studies and Real-World Examples

To illustrate the success of the strategies taught in “Making Good Deals in Bad Times,” it’s beneficial to look at several real-world examples. Below are a few notable case studies that exemplify how investors successfully navigated challenging market conditions using Schaub’s principles:

| Case Study | Strategy Applied | Outcome |

| Investor A | Identifying distressed properties in foreclosure | Acquired multiple properties at 30% below market value; generated significant rental income |

| Investor B | Utilizing creative financing options | Facilitated a purchase with little down payment through owner financing; later refinanced for profit |

| Investor C | Market analysis and timing | Sold properties to raise capital during peak market conditions, enabling reinvestment in undervalued properties when the market slowed |

These examples underscore the effectiveness of Schaub’s teachings, showcasing how investors can thrive by adapting their strategies based on market circumstances. Each case highlights the importance of understanding the local real estate landscape and seizing opportunities as they arise.

In conclusion

“Making Good Deals in Bad Times” by John Schaub is an essential tool for real estate investors negotiating unstable economic conditions. Both new and seasoned investors benefit from his emphasis on practical tactics, market research, and a variety of investment philosophies. Schaub offers a road map for accumulating wealth during difficult times by stressing the value of taking advantage of chances when prices decline. Applying these concepts greatly increases the possibility of good investment outcomes, whether through networking, continuing education, or innovative funding. Schaub’s observations are still applicable and useful in the ever-evolving real estate market, providing a beacon of hope for every investor hoping to prosper in whatever economic climate.

Frequently Asked Questions:

Innovation in Business Models: We use a group purchase approach that enables users to split expenses and get discounted access to well-liked courses. Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations. There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content. This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Control: We make certain that every course resource we buy is the exact same as what the authors themselves provide. It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings: – Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “Making Good Deals In Bad Times by John Schaub” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.