-

×

Physical Preparation 101 by Mike Robertson

1 × $23.10

Physical Preparation 101 by Mike Robertson

1 × $23.10 -

×

Live and Luxurious by Gina Devee

1 × $23.10

Live and Luxurious by Gina Devee

1 × $23.10 -

×

Advanced Metaphysical and Ultra-Height Hypnosis By Jerry Kein

1 × $23.10

Advanced Metaphysical and Ultra-Height Hypnosis By Jerry Kein

1 × $23.10 -

×

PPC Keywords - PPC 4SEO By Derek Booth - SEO Intelligence Agency

1 × $23.10

PPC Keywords - PPC 4SEO By Derek Booth - SEO Intelligence Agency

1 × $23.10 -

×

Oneness & Release Teleworkshop by Carole Dore

1 × $23.10

Oneness & Release Teleworkshop by Carole Dore

1 × $23.10

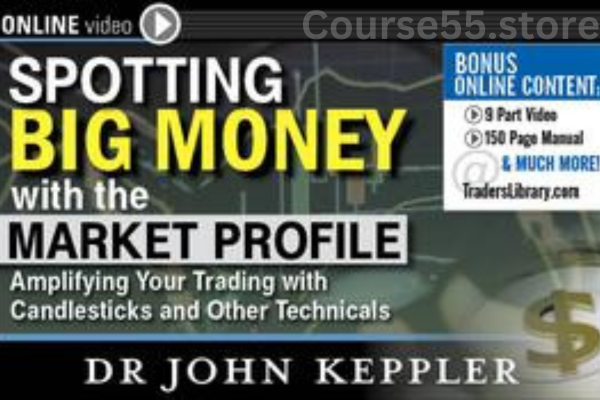

Spotting Big Money with Market Profile By John Kepler

$189.00 Original price was: $189.00.$23.10Current price is: $23.10.

SKU: C55store.5447d0PLqdMn

Category: Download

Tags: Big Money, John Kepler, Market Profile, Spotting

Spotting Big Money with Market Profile By John Kepler – Digital Download!

Content Proof:

Spotting Big Money with Market Profile By John Kepler

Overview:

Examine John Kepler’s Spotting Big Money with Market Profile.

Having the appropriate tools and insights is essential for success in the fast-paced world of trading, where every choice can result in substantial gains or losses. By departing from conventional approaches to leverage the potential of market profile analysis, John Kepler’s course, “Spotting Big Money with Market Profile,” presents a distinctive viewpoint on trading. This course, which is intended for both novice and experienced traders, focuses on using market profile as a tactical tool to improve trading results. Equipped with these insights, traders can make well-informed judgments that, hopefully, result in profitable trading outcomes by understanding price behaviors and market dynamics.

Comprehending the Market Profile

A market profile can show the underlying structure of markets by providing a graphic depiction of price and time. Market profiles offer a more thorough examination of the locations and processes by which prices are produced throughout time, in contrast to conventional charting methods that primarily concentrate on price changes. By showing where buying and selling pressures are most noticeable, this special format assists traders in identifying important value levels during the trading day.

Finding price rejection levels at extreme highs and lows is one of the main benefits of using market profiles. Traders can increase their profitability by making better entrances and exits when they are aware of where these crucial spots are. Furthermore, the knowledge gathered from market profiles can also help them read important reference levels across different electronic marketplaces more accurately.

Key Concepts of Market Profile

The course introduces participants to several critical concepts surrounding market profile, including:

- Time at Price: Measures market activity at specific price levels over a designated period.

- Value Area: Represents the price range where most trading has occurred, which is essential for identifying trends.

- Point of Control (POC): Indicates the price level with the highest volume, serving as a significant support or resistance level.

By mastering these concepts, traders can gain a distinctive competitive edge when analyzing market behavior.

Course Content and Structure

The “Spotting Big Money with Market Profile” course has a strong and well-thought-out structure that can accommodate traders in a variety of markets. Engaging video demonstrations and real-world examples are incorporated into the program to highlight profile-based trading methods that are relevant to the futures, equity, and foreign exchange (forex) markets.

Participants can gain a firsthand understanding of the fundamental profile principles and structures through this multifaceted method. Traders can internalize how market activities differ from traditional trading strategies by immersing themselves in this knowledge.

Specific Skills Acquired

By the end of the course, participants will be able to:

- Accurately identify market value: Understanding where the market sees value is the key to successful trading.

- Spot price rejection: Recognizing when a price is rejected at extremes can signal potential reversal points.

- Read key reference levels: The ability to navigate different electronic markets can vastly improve a trader’s analytical capabilities.

This structured learning environment not only enhances knowledge but also fosters the skills required to implement the learned strategies in live trading scenarios.

Cost and Special Offer

The price of Kepler’s course is one of its best features. The course was originally available for $675.00, however it is now on sale for $59.00. A wider spectrum of traders can now use it thanks to this substantial reduction, especially those who might be hesitant to make large upfront investments.

Value for Money

- Before Discount: $675.00

- Current Price: $59.00

- Discount Percentage: Approximately 91%

This affordability is essential for aspiring traders looking for quality education without facing significant financial barriers. The substantial discount also reflects Kepler’s commitment to democratizing access to high-quality trading education.

Client Contentment

Along with the outstanding value, the course has a thorough refund policy. If participants have problems with the material or feel the program does not live up to their expectations, they can request a refund within 30 days of purchase. In addition to allaying traders’ fears about funding training initiatives, this policy conveys a strong commitment to client satisfaction.

With the knowledge that their investment is safeguarded, traders can participate in the course with confidence thanks to this guarantee.

Refund Policy Highlights

- Period: 30 days from purchase

- Conditions: Full refund if expectations are not met

- Commitment: Customer satisfaction guaranteed

Useful Advice and Techniques

The main objective of “Spotting Big Money with Market Profile” is to give traders useful advice and doable tactics for making efficient use of market profile. The course’s significance extends beyond theoretical understanding; it equips traders with the tactics they need to see noticeable gains in their trading performance.

Practical Use

The following situations are advantageous for traders using market profile strategies:

- putting money into deals at high-value locations, which are usually where there is more trading activity.

- improving risk management skills by spotting possible reversal points at price rejection levels.

- examining market dynamics to identify ideal circumstances for trading different assets, such as futures and forex.

Traders may be able to make their trading activities fruitful by comprehending and utilizing these tactics.

Conclusion

In summary, John Kepler’s “Spotting Big Money with Market Profile” course provides an in-depth look at market analysis that stands apart from traditional methods. The comprehensive structure and invaluable insights make it a worthwhile investment for traders aiming to improve their performance across various markets. With the significant promotional discount, combined with a solid refund policy, the course represents a low-risk opportunity for individuals eager to enhance their trading skills. Ultimately, by mastering the principles of market profile, traders can gain a competitive advantage, enabling them to operate more effectively in the unpredictable world of trading. For those seeking to take their trading to the next level, this course could be a game changer.

Frequently Asked Questions:

Business Model Innovation: We use a group buying approach that enables users to split expenses and get discounted access to well-liked courses.

Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations.

There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content.

This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Assurance: We guarantee that every course resource you buy is exactly the same as what the authors themselves are offering.

It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings:

– Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “Spotting Big Money with Market Profile By John Kepler” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.